A private investment firm built for individuals and family offices

We make direct investments in Private Equity and Real Estate out of Anagram-managed funds

Institutional investing, built for individuals

| Traditional Firms | Anagram | |

|---|---|---|

| Direct investment opportunities available to all fund investors | ||

| Smaller funds with lower minimums | ||

| Transparency and access to investment teams | ||

| Modern and seamless technology | ||

| Consistent due diligence and deal underwriting standards | ||

| Expert industry-specific advisory teams | ||

| Professional reporting standards | ||

| Access to off-market transactions and proprietary dealfow |

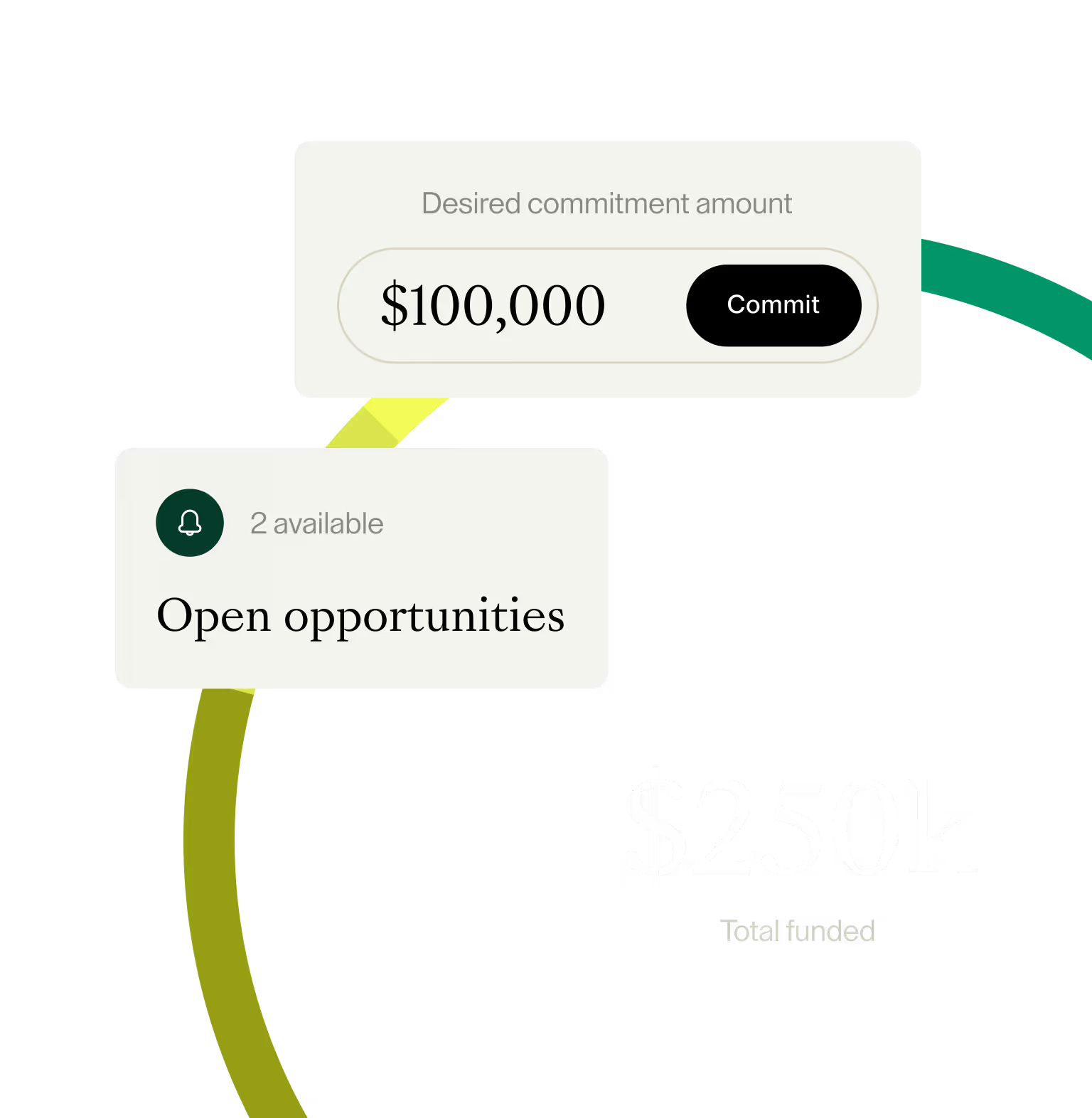

Diversify through funds, customize through direct investments

Our funds make direct investments in Private Equity and Real Estate opportunities.

We reserve a portion of each investment for Upsizes, allowing fund investors to increase exposure to investments on a deal-by-deal basis and build a bespoke portfolio of private market holdings.

Founded by operators and investors, united by a shared vision

Private Equity and Real Estate are asset classes that individuals should have in their portfolios.

But nearly all private investment firms are built for large institutions, not individuals.

Special features such as access to the investment team, direct deal opportunities and transparency are reserved for the largest investors – making individuals the least important investor in these funds, even when they can access them.

We built Anagram to change that.

Begin building your Anagram portfolio

Join our community of founders, executives, investors, and operators and start building your own private investments portfolio

Get in touch